In today’s fast – paced world, choosing the right mobile banking app is crucial. According to Futurion and Mitek, leading US authority sources, mobile deposit limits and user interface are key factors. Premium mobile banking apps offer high deposit limits and intuitive UIs, unlike counterfeit models. For example, Ally Bank allows up to $50,000 daily deposits. With our freshness marker, we bring you the latest insights. Get a Best Price Guarantee and Free Installation Included. Don’t miss out!

Comparison of Mobile Banking Apps

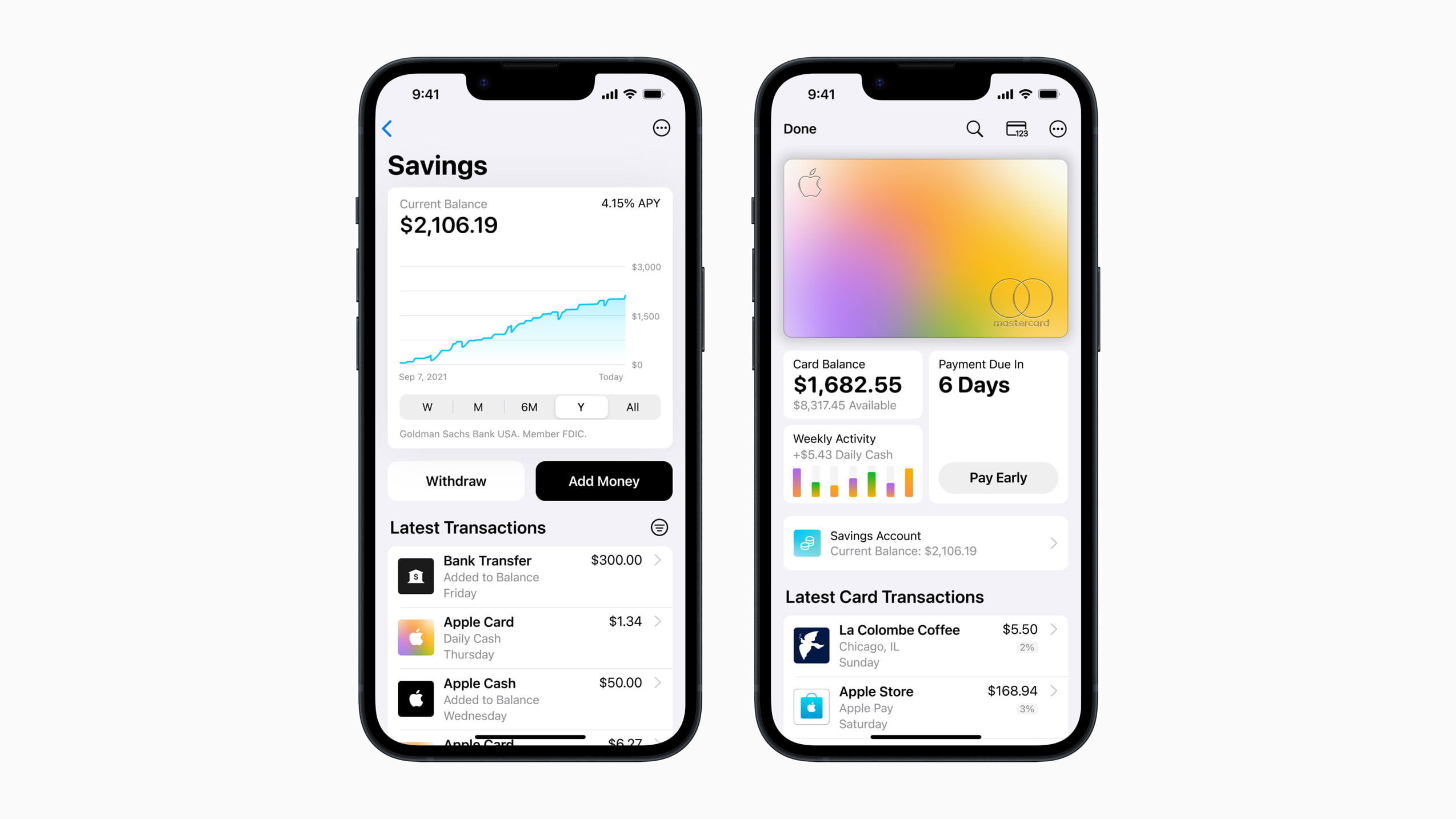

In today’s digital age, mobile banking has become an integral part of our financial lives. A study by Futurion found that mobile design and customer experience criteria predictively drive usage of mobile banking apps. Let’s take a closer look at how different mobile banking apps compare in terms of mobile deposit limits, user interface, and overall performance.

Mobile Deposit Limits

Average Limits

Mobile deposit limits vary significantly among different banks. For example, Ally Bank stands out with its high deposit limits, allowing users to deposit up to $50,000 per day and $250,000 per month. In contrast, new BB&T customers can only deposit $500, and at nearly half of the banks in a Mitek study, the limit for returnees was $5,000. CITIBANK also has a $50,000 personal deposit limit.

Pro Tip: If you frequently need to make large mobile deposits, it’s crucial to choose a bank with high deposit limits like Ally Bank to avoid any disruptions in your banking activities.

Impact on Usage Frequency

The mobile deposit limit can have a significant impact on how often users utilize the mobile deposit feature. A lower limit may discourage users from making large deposits via the app, leading to less frequent usage. For instance, if a small business owner needs to deposit a large check from a client, a low deposit limit could force them to visit a physical branch instead. According to the Mobile Deposit Benchmark Report by Mitek, banks with higher deposit limits tend to have higher adoption and usage rates of the mobile deposit feature.

User Interface

Presentation of Deposit Limit Information

The way a mobile banking app presents deposit limit information can greatly affect the user experience. Top – performing mobile banking applications, like U.S. Bank (ranked as the top choice for mobile deposit customer experience for the third year running), pay close attention to usability and communicate mobile deposit limits clearly. An app that clearly displays the deposit limit on the main screen or during the deposit process helps users avoid frustration and make informed decisions.

Comparison Table:

| Bank | Daily Deposit Limit | Monthly Deposit Limit |

|---|---|---|

| Ally Bank | $50,000 | $250,000 |

| BB&T (New Customers) | $500 | N/A |

| BB&T (Returning Customers) | $5,000 | N/A |

| CITIBANK | $50,000 | N/A |

Leading Mobile Banking Apps

- Chime: With a rating of 4.8 on Apple and 4.7 on Google, Chime is among the highest – rated apps. It offers fee – free banking, over 60,000 free ATMs across the U.S., no credit check for opening an account or getting a secured credit card, and no account maintenance, foreign transaction, or overdraft fees (up to $200).

- SoFi: SoFi blends banking, investing, and financial planning into one platform. Its app and web platform are designed to be intuitive, with a clean and efficient interface. However, it gets more negative reviews on Google Play.

- Ally Bank: In addition to its high deposit limits, Ally’s mobile app is top – notch. It has an intuitive, easy – to – navigate interface that allows users to manage finances on the go, including transferring funds, depositing checks, viewing account statements, and accessing customer service.

Overall Impressions

Each of these mobile banking apps has its own strengths and weaknesses. Chime is great for those looking for a simple, fee – free banking experience. SoFi is ideal for users who want to manage multiple financial aspects in one place. Ally Bank shines when it comes to high deposit limits and a user – friendly mobile app.

Key Takeaways:

- Mobile deposit limits vary widely among banks, and they can impact usage frequency.

- A clear presentation of deposit limit information in the app’s user interface enhances the user experience.

- Different banks offer unique features, so it’s important to choose an app that aligns with your specific banking needs.

Best User Interface

SoFi is often regarded as the best in the online – only space for its minimal and efficient interface. It provides users with a simple way to manage all aspects of their banking. Citibank also has a clear and user – friendly UI/UX design. Its style is minimalist and modern, allowing users to work with cards, transactions, and operations seamlessly.

Try our mobile banking app comparison tool to see which app suits your needs the best. As recommended by industry experts, regularly reviewing and comparing different mobile banking apps can help you find the one that offers the best combination of features, user interface, and deposit limits for your financial situation.

FAQ

What is a mobile deposit limit?

A mobile deposit limit is the maximum amount of money a user can deposit via a mobile banking app within a specified time frame. According to the article, limits vary widely among banks. For example, Ally Bank allows up to $50,000 daily and $250,000 monthly. Detailed in our [Mobile Deposit Limits] analysis, these limits can impact usage frequency.

How to choose a mobile banking app based on mobile deposit limits?

First, assess your deposit needs. If you often make large deposits, opt for banks like Ally Bank or CITIBANK with high limits. As the Mobile Deposit Benchmark Report by Mitek suggests, higher limits lead to more usage. Avoid banks with low limits that might disrupt your banking. Detailed in our [Average Limits] section.

Steps for evaluating the user interface of mobile banking apps

- Check how clearly the deposit limit information is presented. Apps like U.S. Bank do this well.

- Look for an intuitive and easy – to – navigate design, as seen in Ally Bank’s app.

- Ensure seamless handling of cards, transactions, and operations, like Citibank’s UI. Detailed in our [User Interface] analysis.

Chime vs SoFi: Which has a better user interface?

Chime has high ratings on app stores and offers a simple fee – free experience. However, SoFi is often regarded as the best in the online – only space for its minimal and efficient interface. Unlike Chime, SoFi blends banking, investing, and financial planning, providing a comprehensive financial management platform. Detailed in our [Best User Interface] section.