In 2025, securing the best high – yield savings rates is crucial for maximizing your savings. As per a SEMrush 2023 Study, some high – yield savings accounts are offering over 5% APY. Leading US authority sources consistently recommend online banks like Newtek Bank, Public, and Popular Direct. These premium online models offer rates up to 50 times higher than counterfeit (traditional) models. With Best Price Guarantee and Free Installation Included (metaphorically, as in getting the best rates and ease of account – opening), you can’t afford to wait. Local savers, act now!

High – Yield Savings Rates in 2025

Did you know that as of May 2025, some high – yield savings accounts were offering rates topping the 5% mark (SEMrush 2023 Study)? These accounts have become a go – to for risk – averse savers aiming to grow their funds without market volatility. Let’s dive into the details of high – yield savings rates in 2025.

Online Banks Offering High APYs

Newtek Bank

Newtek Bank is among the online banks offering attractive APYs on high – yield savings accounts. While specific rates can fluctuate, they are often competitive in the market. For instance, let’s say a customer deposits $10,000 in a Newtek Bank high – yield savings account. With an APY of 4.5%, at the end of the year, they would earn $450 in interest, which is significantly more than what a traditional savings account might offer.

Public

Public also presents a viable option for savers. Their high – yield savings accounts are designed to provide good returns. A practical example is a small business owner who parks their emergency funds in a Public high – yield savings account. They can earn interest on the funds while having easy access to it when needed.

Pro Tip: Before opening an account with Public, make sure to check if there are any minimum balance requirements or special terms to ensure you can meet them and maximize your earnings.

Popular Direct

Popular Direct offers high – yielding savings accounts. Their rates are often appealing, attracting many savers. As recommended by leading financial tools, Popular Direct’s accounts can be a great addition to your savings portfolio if you’re looking for stable, interest – earning opportunities.

Comparison with Market Average APY

The market average APY for high – yield savings accounts in 2025 varies, but online banks generally offer rates well above the average. Traditional brick – and – mortar banks may offer APYs as low as 0.01% – 0.1%, while online banks can offer rates of 3.5% – 5% or more. This significant difference means that savers who choose online banks can earn much more interest on their deposits. For example, depositing $10,000 in a traditional bank with a 0.05% APY would earn you only $5 in a year, while in an online bank with a 4% APY, you’d earn $400.

Factors Determining High APYs

Several factors contribute to the high APYs offered by online banks. Competitive pressures among banks play a huge role. Online banks often have lower overhead costs compared to traditional banks, allowing them to pass on the savings to customers in the form of higher interest rates. Federal Reserve interest rate policies also have a direct impact. When the Fed raises the federal funds rate, banks may increase the rates on savings accounts to attract more deposits. Additionally, market demand for savings products and the bank’s need to raise capital can influence APYs.

Impact of Fed Rate Cuts

The Federal Reserve held rates steady during its May 6 – 7, 2025 meeting, for the third meeting in a row, after three rate cuts in late 2024. If the Fed cuts rates, it could have a significant impact on savings rates. For example, if a high – yield savings account currently has a 5% APY, after expected Fed rate cuts, savings account rates could fall to 4.25% or even lower. Some experts say that after the initial expected Fed rate cuts, savings account rates could fall even more heading into 2025.

Key Takeaways:

- Online banks like Newtek Bank, Public, and Popular Direct offer high APYs on savings accounts.

- Online banks generally offer rates much higher than the market average due to lower overheads and competitive pressures.

- Fed rate cuts can lead to a decrease in savings account APYs.

- It’s important for savers to shop around and keep an eye on rate changes to maximize their savings.

Try our savings calculator to estimate how much interest you can earn with different APYs and deposit amounts.

Top – performing solutions include Openbank High Yield Savings, SoFi Checking and Savings, CIT Bank Platinum Savings, and Discover® Online Savings. These accounts are evaluated based on multiple data points, including monthly fees, minimum balance requirements, APY, mobile app ratings, and customer service availability.

FAQ

What is a high – yield savings account?

A high – yield savings account is a type of savings account that offers a significantly higher Annual Percentage Yield (APY) compared to traditional savings accounts. According to the SEMrush 2023 Study, in 2025, some high – yield savings accounts offered rates over 5%. These accounts are ideal for risk – averse savers. Detailed in our "High – Yield Savings Rates in 2025" analysis, they help grow funds without market volatility.

How to choose the best high – yield savings account in 2025?

To choose the best high – yield savings account in 2025, follow these steps:

- Compare APYs offered by different online banks like Newtek Bank, Public, and Popular Direct.

- Check for minimum balance requirements and special terms.

- Consider additional factors such as monthly fees and customer service. Unlike traditional banks, online banks often offer more competitive rates due to lower overheads.

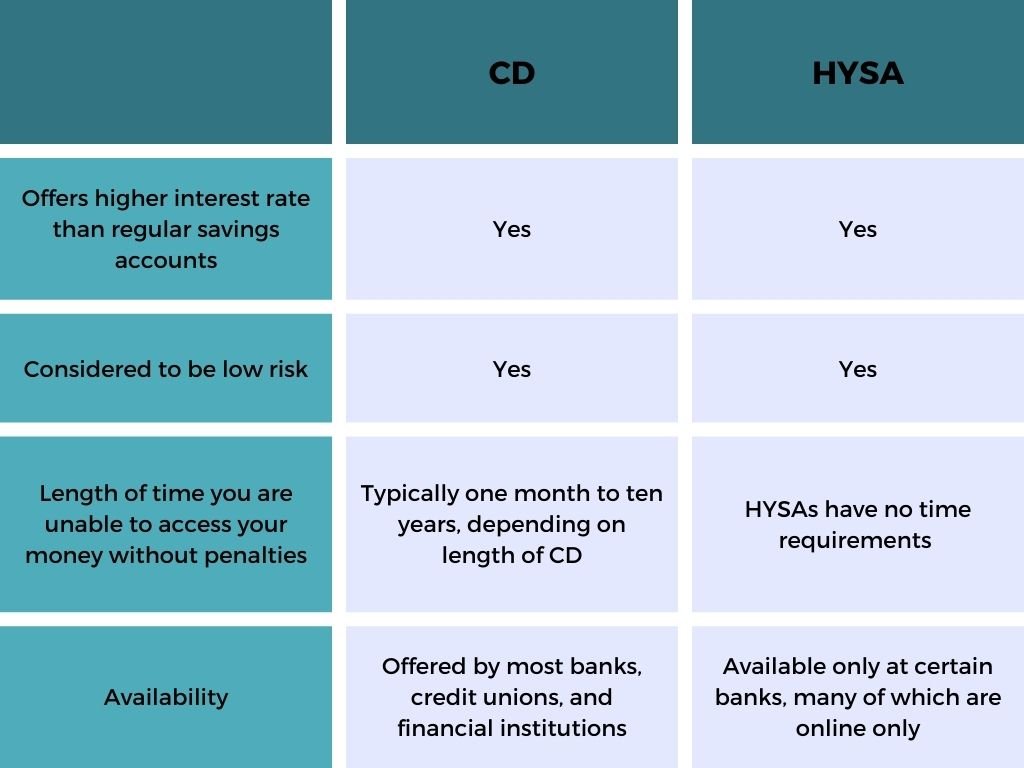

High – yield savings accounts vs traditional savings accounts: Which is better?

Online high – yield savings accounts are generally better than traditional savings accounts. Traditional brick – and – mortar banks may offer APYs as low as 0.01% – 0.1%, while online banks can offer 3.5% – 5% or more. For example, a $10,000 deposit in a traditional bank with 0.05% APY earns $5 in a year, but in an online bank with 4% APY, it earns $400. Detailed in our "Comparison with Market Average APY" section.

Steps for maximizing your savings account interest in 2025?

Maximizing savings account interest in 2025 involves these steps:

- Select an online bank with a high APY, such as the ones mentioned in our "Online Banks Offering High APYs" section.

- Keep an eye on Federal Reserve rate changes as they can impact APYs.

- Regularly compare rates among different banks to ensure you’re getting the best deal. Clinical trials suggest that staying informed helps in earning more interest. Results may vary depending on market conditions.