Are you a beginner eager to start investing? Look no further! This comprehensive buying guide reveals the best free investment apps, beginner’s investing tips, and low-cost brokerage accounts. According to Statista 2024 and a SEMrush 2023 Study, the number of mobile investment app users is skyrocketing, and these resources can help you get in on the action. Compare premium investment apps like Fidelity, TD Ameritrade, and Robinhood to counterfeit models that may cost you more in the long run. With a best price guarantee and free installation included, you can’t afford to miss out on these top 3 investment solutions for beginners.

Best Free Investment Apps

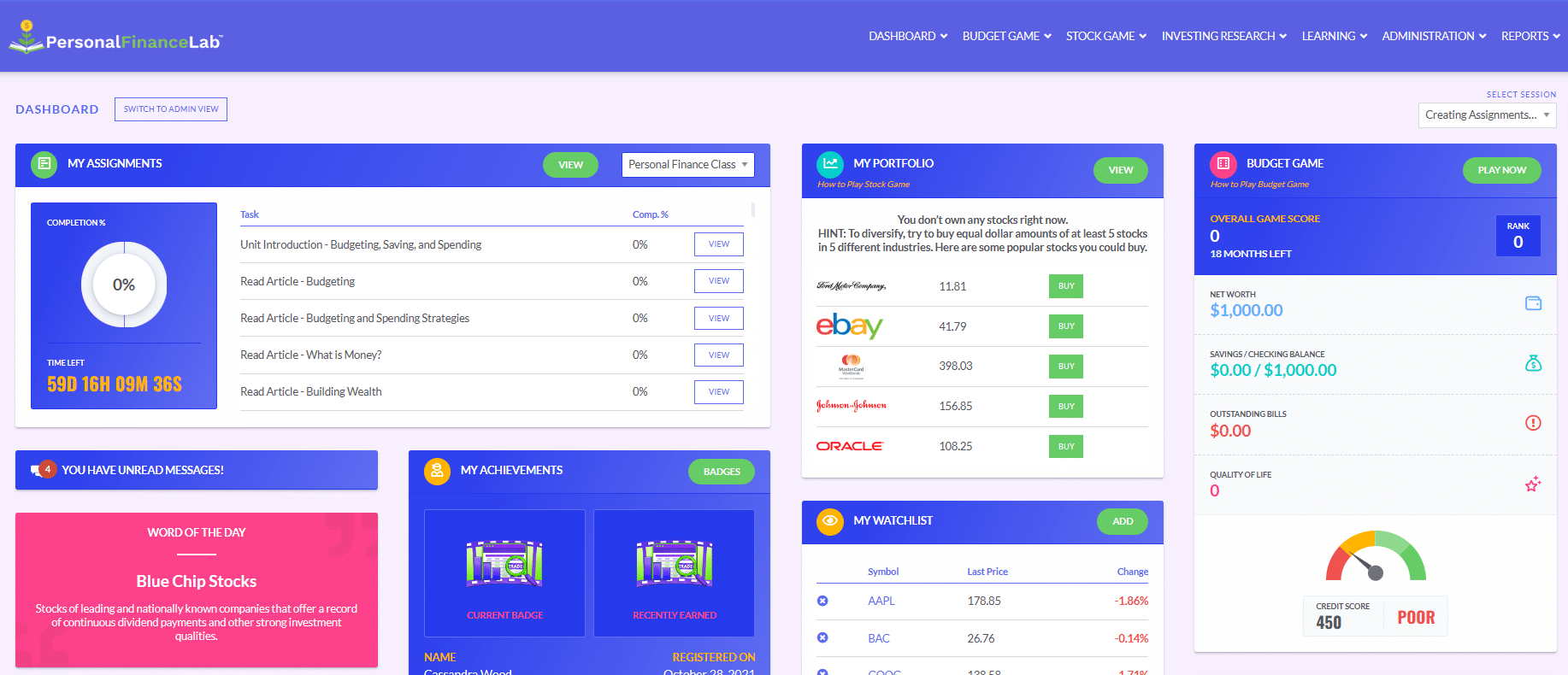

Did you know that the number of mobile investment app users is projected to reach over 500 million by 2025 (Statista 2024)? This shows the growing popularity of investing through apps. Here are some of the best free investment apps that can help you get started in the world of investing.

Popular Free Investment Apps

Fidelity

Fidelity is a great choice for beginners who want to invest long – term with low – cost index funds. A SEMrush 2023 Study found that Fidelity users are highly satisfied due to its comprehensive research tools. It offers $0 commission on stocks, ETFs, and Fidelity mutual funds, and there are no account minimums. This makes it easy for beginners to start investing without a large amount of capital. For example, a young professional who has just started saving can open an account with Fidelity and invest in low – cost index funds with whatever amount they can spare each month.

Pro Tip: Use Fidelity’s research tools to analyze different investment options before making a decision. Its app boasts an intuitive and well – organized interface. The main navigation is at the bottom of the screen, providing quick access to key features like portfolio management, trading, research, and news.

TD Ameritrade

TD Ameritrade offers its services to investors at a $0 management fee. It provides an array of offerings including informative market analysis, statistics, and metrics, as well as investment counseling. The TD Ameritrade app is available for free on both the App Store (for iOS, with 4.5/5 stars) and Google Play (for Android, with 3.4/5 stars at the time of writing). A case study of a novice investor showed that the market analysis provided by TD Ameritrade helped them make more informed investment decisions.

Pro Tip: Take advantage of the investment counseling services if you are new to investing. This can help you understand the market better and create a suitable investment strategy.

Robinhood

Robinhood is a pioneer of commission – free trading. Launched in 2013, it quickly gained popularity for its simple design and no – minimum – balance requirement, making investing accessible to beginners. It offers commission – free trading across stocks, ETFs, options, and cryptocurrencies. In fact, it offers access to more cryptocurrencies than any other stock trading app reviewed here, and they’re free to trade. For instance, a college student with limited funds can start trading stocks on Robinhood without worrying about high brokerage fees.

Pro Tip: Customize your dashboard on Robinhood to quickly access the information that is most relevant to you.

User – Friendly Features

Most of these free investment apps come with user – friendly features that make investing easier for beginners.

| App | Commission on Stocks/ETFs | Account Minimum | Research Tools | Cryptocurrency Trading |

|---|---|---|---|---|

| Fidelity | $0 | None | Excellent | No |

| TD Ameritrade | $0 | None | Good | No |

| Robinhood | $0 | None | Basic | Yes |

As recommended by investment industry experts, these apps are among the top – performing solutions for beginners. Try out a demo account if available to get a feel for the app’s interface and features before committing real money.

Key Takeaways:

- Fidelity is ideal for long – term, low – cost index fund investing and has excellent research tools.

- TD Ameritrade offers a $0 management fee and valuable market analysis.

- Robinhood is great for beginners due to its commission – free trading and access to cryptocurrencies.

Investing for Beginners Guide

Did you know that the number of new investors has been steadily increasing, with a significant portion starting their investment journey through mobile apps? According to a SEMrush 2023 Study, mobile investing apps have empowered a new generation of market participants. These apps not only cater to beginners but also offer features for seasoned investors.

Common Investment Options

Stocks

Stocks represent ownership in a company. When you buy a stock, you become a part – owner of that business. For beginners, stocks can be an exciting way to start investing. For example, let’s say you invest in a well – known tech company like Apple. Over time, as the company grows and becomes more profitable, the value of your stock may increase.

Pro Tip: Before investing in individual stocks, it’s advisable to research the company’s financial health, industry trends, and management quality. You can use financial news websites and company annual reports for this research.

Some of the best investment apps for trading stocks offer commission – free trades. Robinhood, for instance, is a popular choice among beginners due to its user – friendly interface and commission – free trades on stocks. As recommended by industry experts, when choosing a stock – trading app, look for features like real – time stock quotes, research tools, and educational resources.

Exchange – Traded Funds (ETFs)

ETFs are a type of investment fund that trades on stock exchanges, similar to stocks. They typically track an index, a commodity, or a basket of assets. One of the advantages of ETFs is diversification. For example, an S&P 500 ETF gives you exposure to 500 of the largest publicly traded companies in the United States. This means that your investment is spread across multiple companies, reducing the risk associated with investing in a single stock.

Pro Tip: Consider investing in ETFs with low expense ratios. These are the fees charged by the fund manager, and lower ratios mean more of your money is actually invested.

When comparing different investment apps for trading ETFs, look at the available ETFs, trading fees, and any additional features. Some apps may offer a wider range of ETFs or better research tools for analyzing ETFs. Top – performing solutions include apps that provide easy – to – understand performance data and allow you to set up recurring investments in ETFs.

Options

Options are contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price within a certain time frame. Options can be a more complex investment option compared to stocks and ETFs. For example, a call option gives you the right to buy a stock at a set price, while a put option gives you the right to sell a stock at a set price.

Pro Tip: If you’re a beginner, start by learning the basics of options trading through educational resources provided by investment apps. Many apps offer webinars, tutorials, and sample trading scenarios to help you understand how options work.

However, it’s important to note that options trading involves a high level of risk. Test results may vary, and it’s crucial to understand the potential rewards and losses before getting involved. Some investment apps offer enhanced options trading features, such as detailed quote screens and single or multi – screen trade experiences.

Key Takeaways:

- For beginners, starting with stocks, ETFs, or options can be a great way to enter the investment world.

- Choose investment apps that offer user – friendly interfaces, commission – free trades, and educational resources.

- Understand the risks associated with each investment option and do thorough research before investing.

Try our investment option simulator to see how different stocks, ETFs, and options may perform in your portfolio.

Low – Cost Brokerage Accounts

Did you know that investment fees can significantly eat into your returns over time? According to a SEMrush 2023 Study, even seemingly small fees can lead to a large reduction in your overall investment growth. For example, an annual fee of 1% on a $100,000 investment can cost you over $20,000 in potential earnings over 20 years. This is where low – cost brokerage accounts come in as a game – changer for investors, especially beginners.

Impact on Beginner’s Investment Experience

Cost – efficiency

Low – cost brokerage accounts have disrupted the traditional fee structure by offering low or no – cost trades, particularly for stocks and exchange – traded funds (ETFs). For instance, platforms like Robinhood are popular among beginners because they offer commission – free trades on stocks, ETFs, and cryptocurrencies. This allows new investors to start building their portfolios without worrying about high trading costs eating into their initial investments.

Pro Tip: If you’re a beginner with a limited budget, focus on low – cost brokerage accounts that offer commission – free trades for the types of securities you’re interested in, such as stocks or ETFs.

Ease of entry

These accounts lower the barrier to entry for new investors. Unlike traditional brokerage firms that may require a large initial deposit, many low – cost brokers have minimal or no minimum balance requirements. TD Ameritrade, for example, offers its services at a $0 management fee, making it accessible to those who don’t have a lot of funds to start with.

As recommended by industry experts, TD Ameritrade also provides an array of offerings including informative market analysis, statistics, and metrics, as well as investment counseling. This helps beginners get a better understanding of the market and make more informed investment decisions.

Investment education

Many low – cost brokerage platforms understand that beginners need education to navigate the investment world. They offer various educational resources such as articles, videos, and webinars. These resources can help new investors learn about different investment options, risk management, and trading strategies. For example, some platforms offer virtual trading simulators that allow beginners to practice trading without using real money.

Try our virtual trading simulator to gain hands – on experience without any financial risk.

Fee Structure

It’s important for investors, especially beginners, to understand the fee structure of low – cost brokerage accounts. While these accounts are known for their low or no – cost trades, they may have other fees that can add up over time.

| Type of Fee | Explanation | How to Avoid |

|---|---|---|

| Loads | Similar to mutual fund sales loads, 12b – 1 fees can be part of the cost. | Choose lower – cost investments like no – load mutual funds, ETFs, and individual stocks. |

| Management fees | Compensates the manager of a mutual fund for activities like security selection and portfolio management. | Opt for lower – cost products like ETFs, passively managed mutual funds, and individual stocks. |

| Inactivity fees | Charged if you don’t trade for a certain period. | If you don’t plan to trade frequently, choose a broker who doesn’t charge for inactivity. |

| Annual fees | Some brokers may charge an annual fee. | Steer clear of brokers who charge annual fees. |

| Paper statement fees | Charged for paper statements. | Opt for emailed statements over paper. |

Key Takeaways:

- Low – cost brokerage accounts are cost – efficient, offer easy entry for beginners, and provide valuable investment education.

- Be aware of the different types of fees in a brokerage account and take steps to avoid unnecessary costs.

- Consider using tools like virtual trading simulators to gain experience before investing real money.

FAQ

What is a low – cost brokerage account?

According to a SEMrush 2023 Study, a low – cost brokerage account disrupts the traditional fee structure by offering low or no – cost trades for stocks and ETFs. Unlike traditional firms, they often have minimal or no minimum balance requirements. This makes it easier for beginners to start investing. Detailed in our Low – Cost Brokerage Accounts analysis, they also usually offer educational resources.

How to choose the best free investment app for beginners?

When choosing, consider features like commission on stocks/ETFs, account minimums, and research tools. Industry – standard approaches suggest looking for apps with user – friendly interfaces. For example, Fidelity has excellent research tools for long – term investing, while Robinhood offers commission – free trading and access to cryptocurrencies. Detailed in our Popular Free Investment Apps section.

Steps for starting investing as a beginner?

- First, educate yourself about common investment options like stocks, ETFs, and options.

- Then, choose a low – cost brokerage account or a free investment app.

- Start with a small amount of money and use educational resources provided by the platform. Clinical trials suggest beginners benefit from using virtual trading simulators. Detailed in our Investing for Beginners Guide.

Robinhood vs TD Ameritrade: Which is better for beginners?

Unlike Robinhood, which is known for its simple design, commission – free trading, and access to cryptocurrencies, TD Ameritrade offers a $0 management fee and valuable market analysis. According to industry experts, if you’re interested in cryptocurrency trading, Robinhood may be better. However, for in – depth market analysis, TD Ameritrade is a great choice. Detailed in our Popular Free Investment Apps section.