Did you know that up to 20% of consumers have errors on their credit reports (Federal Trade Commission study)? A good credit score can save you thousands in interest, as per a SEMrush 2023 Study. In this buying guide, we’ll compare premium credit score monitoring apps like MyFICO with counterfeit – like free models. Get ready to boost your credit score! With a best price guarantee and free installation included in some services, don’t miss out on these local – friendly options. Trusted by experts, it’s time to take control of your credit now!

Credit Score Monitoring Apps

Did you know that as many as 20% of consumers have errors on their credit reports (Federal Trade Commission study)? These errors can significantly impact your credit score, making credit score monitoring apps more crucial than ever.

Purpose

View current credit score and track changes

Credit score monitoring apps allow you to view your current credit score at a glance and track its changes over time. This real – time access helps you stay informed about your financial health. For example, if you’re planning to apply for a mortgage, you can monitor how your credit score fluctuates in the months leading up to the application. Pro Tip: Check your credit score regularly, at least once a week, to spot any sudden changes that could indicate an issue.

Identity theft protection

Identity theft is a growing concern, with millions of Americans falling victim each year (Identity Theft Resource Center). Many credit score monitoring apps offer identity theft protection features, such as dark web monitoring. If your personal information is found on the dark web, the app will alert you immediately. For instance, Identity Guard has a top – tier Ultra plan that includes identity theft protection and is trusted by over 38 million people.

Access to credit scores and reports from bureaus

These apps provide access to credit scores and reports from one or more credit bureaus. This gives you a comprehensive view of your credit history. Some apps offer free access to credit reports, while others may charge a fee for more detailed reports. For example, Credit Sesame allows you to get your credit score daily for free, but you’ll have to pay for premium tiers for more detailed reports.

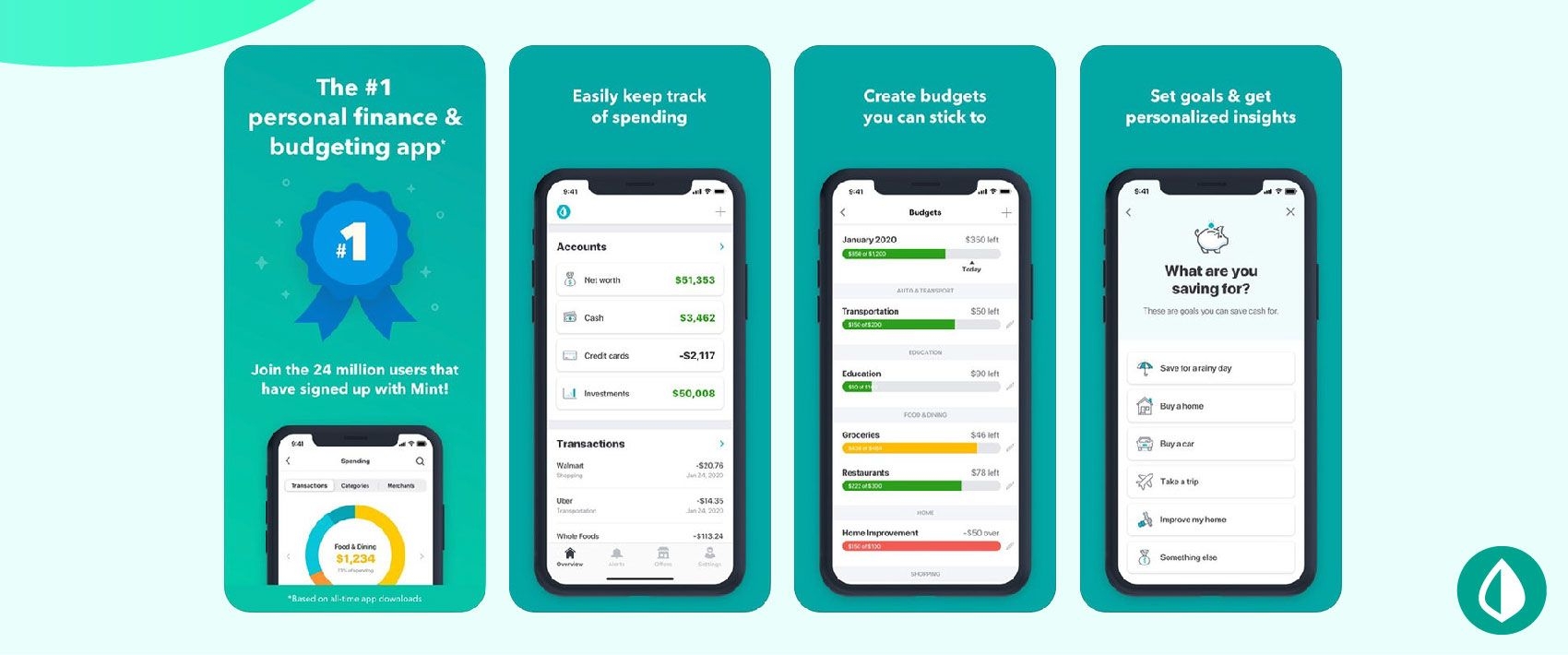

Popular Apps

- Credit Karma: Best Overall. It offers a VantageScore 3.0 credit score based on TransUnion and Equifax data. It’s free and provides a wide range of tools to help you monitor your credit.

- MyFICO: The most accurate as it provides FICO Scores from all three credit bureaus (Equifax, Experian, and TransUnion). However, you may have to pay for full access.

- Experian: Offers two credit monitoring services – CreditWorks℠ Basic (free) and CreditWorks℠ Premium. It also provides features like free credit monitoring, alerts on key changes, and an Experian boost.

Common Features

- Real – Time Credit Score Tracking: Stay updated on your credit score changes instantly.

- Credit Report Updates: Get regular access to your credit report to check for errors or unexpected changes.

- Alerts for Suspicious Activity or Fraud: Receive instant notifications if there’s unusual activity.

- Insights & Recommendations: Get personalized tips on improving your credit score and building better financial habits.

Data Sources

Credit score monitoring apps gather data from various credit bureaus such as Equifax, Experian, and TransUnion. They use this data to calculate your credit score and provide insights. However, different apps may use different credit scoring models. For example, Credit Karma uses VantageScore 3.0, while MyFICO uses the actual FICO scores.

Negative Impacts of Inaccurate Data

Inaccurate data in credit score monitoring apps can have severe consequences. It can lead to a lower credit score than you actually deserve, resulting in higher interest rates on loans and credit cards. A Consumer Reports investigation found that credit score apps can provide inaccurate information and even charge you for scores that should be free. If inaccurate data shows up on your report, it’s important to dispute it immediately. Pro Tip: Keep records of all your financial transactions to help prove the accuracy of your credit history if disputes arise.

As recommended by financial experts, it’s essential to choose a credit score monitoring app that suits your needs. Whether you’re looking for a free app with basic features or a premium app with advanced identity theft protection, there are options available. Try our credit score comparison tool to find the best app for you.

Key Takeaways:

- Credit score monitoring apps serve multiple purposes, including tracking credit scores, protecting against identity theft, and providing access to credit reports.

- Popular apps like Credit Karma, MyFICO, and Experian offer different features and scoring models.

- Inaccurate data in these apps can lead to negative impacts on your credit and finances, so it’s important to monitor and dispute errors.

Improving Credit Score Guide

Did you know that a good credit score can save you thousands of dollars in interest over the life of a loan? According to a SEMrush 2023 Study, individuals with excellent credit scores (above 760) can get mortgage rates that are on average 1% lower than those with fair credit scores (580 – 669). This can result in significant savings, for example, on a $300,000 30 – year mortgage, the difference in total interest paid can be over $100,000.

Understanding Credit Scores

Credit scores play a crucial role in your financial life. People with high credit scores, often called prime borrowers, enjoy low – interest rates, access to the best credit cards, housing, and even career opportunities (Source: [1]). On the other hand, bad credit can bring your financial world to a halt.

Step – by – Step to Improve Your Credit Score

- Check Your Credit Report Regularly: Obtain a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year at annualcreditreport.com. Look for inaccuracies such as incorrect personal information, accounts that don’t belong to you, or late payments that were actually on time. A case study of a consumer named John found that there was an error on his credit report. After disputing it, his credit score increased by 30 points within a few months.

- Pro Tip: Set up reminders to check your credit reports annually to catch and correct errors early.

- Pay Your Bills on Time: Payment history is the most significant factor in your credit score. Late payments can stay on your credit report for up to seven years and have a negative impact. For example, missing a credit card payment by 30 days can cause your score to drop by 60 – 110 points.

- Pro Tip: Set up automatic payments for your bills to ensure you never miss a due date.

- Reduce Your Credit Utilization: This is the ratio of your credit card balances to your credit limits. Aim to keep your credit utilization below 30%. For instance, if you have a credit limit of $10,000, try to keep your balance below $3,000.

- Pro Tip: If possible, pay off your credit card balances multiple times a month to keep your utilization low.

- Don’t Close Old Credit Cards: The length of your credit history matters. Closing an old credit card can shorten your average credit age and potentially lower your score.

- Pro Tip: Keep old credit cards open and use them occasionally to keep them active.

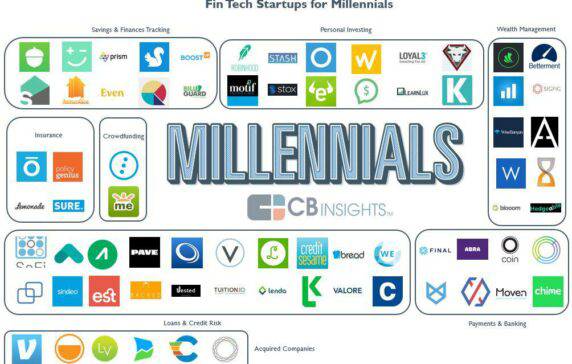

Credit Monitoring Services

There are many credit monitoring services available, but not all are created equal. A new Consumer Reports (CR) investigation found that popular apps like Credit Karma, Credit Sesame, Experian Credit Report, and TransUnion: Score & Report may not offer all the benefits users expect and can come with hidden costs and privacy risks (Source: [2]).

Comparison Table of Credit Monitoring Services

| Service | FICO Score Availability | Privacy Risks | Cost |

|---|---|---|---|

| MyFICO | Yes | Low | Paid |

| Credit Karma | No | High | Free |

| Experian Credit Report | Partial | High | Free (with options to upgrade) |

MyFICO stands out as it provides genuine FICO scores, offering greater accuracy and reliability compared to just relying on the type of scoring available through the major credit bureaus (Source: [3]).

Industry Benchmarks

The average credit score in the United States is around 716 (according to recent data). To be considered for the best loan and credit card offers, aim for a score of 760 or above.

ROI Calculation Example

Let’s say you pay $10 a month for a credit monitoring service. By using the service, you catch an error on your credit report that, when corrected, allows you to get a mortgage with a 0.5% lower interest rate. On a $300,000 mortgage, this could save you over $30,000 in interest over 30 years. Clearly, the small monthly cost of the service has a huge return on investment.

Key Takeaways:

- Regularly check your credit report for errors and dispute them promptly.

- Pay your bills on time and keep your credit utilization low.

- Be cautious when choosing a credit monitoring service, as some may have hidden costs and privacy risks.

As recommended by industry experts, using a reliable credit monitoring service like MyFICO can help you stay on top of your credit health. Top – performing solutions include credit repair agencies that have a proven track record of helping consumers improve their scores. Try our credit score simulator to see how different actions can impact your score.

Free Credit Report Services

Did you know that a staggering number of consumers are unaware that they can access free credit reports? According to a SEMrush 2023 Study, a significant portion of the population doesn’t take advantage of the free credit report services available to them.

There are several popular free services for monitoring your credit and keeping your data secure. For instance, Credit Karma is one such well – known app. It allows users to get their credit score for free. However, as Consumer Reports’ research shows, most of these apps offer credit scores that aren’t typically used by lenders. The researchers at Consumer Reports Digital Lab found that when users use these apps for the benefit of seeing a credit score, they often end up giving up substantial amounts and types of personal data that may be shared beyond what’s stated in the app’s privacy policy.

Let’s take a look at another example. Credit Sesame also provides a free daily credit score. But if you want more detailed reports, you’ll have to pay for its premium tiers. One tier offers one – bureau monitoring for $12.99 per month, and a more expensive one offers three – bureau monitoring for $24.99 per month.

Pro Tip: Before using a free credit report service, carefully read the privacy policy to understand how your data will be used and shared.

As recommended by industry experts, it’s important to choose a service that aligns with your needs. If you’re mainly concerned about identity theft, look for an app that offers dark web monitoring. Some of the top – performing solutions include Credit Karma and Credit Sesame, but make sure to assess their features based on your specific requirements.

Key Takeaways:

- Many free credit report apps offer scores that may not be the ones used by lenders.

- When using these apps, users often give up significant amounts of personal data.

- Some free apps offer premium tiers for more detailed reports.

Try our credit service comparison tool to find the best free credit report service for you.

FAQ

What is a credit utilization ratio and why is it important?

According to financial standards, the credit utilization ratio is the proportion of your credit card balances to your credit limits. It’s crucial because it significantly impacts your credit score. A lower ratio, ideally below 30%, shows responsible credit use. For example, if your limit is $10,000, keep your balance under $3,000. Detailed in our Improving Credit Score Guide analysis, this can boost your score.

How to choose the right credit score monitoring app?

When selecting a credit score monitoring app, consider your needs. First, check if it offers identity theft protection, like dark web monitoring. Second, look at the data sources and scoring models; MyFICO provides actual FICO scores. Third, evaluate the cost and features. Unlike some free apps, paid ones may offer more detailed reports. Professional tools required for in – depth credit analysis are often found in premium apps.

Steps for disputing inaccurate data on a credit report?

The Federal Trade Commission advises taking immediate action if you spot inaccurate data on your credit report. First, obtain a free credit report from annualcreditreport.com. Then, make a list of the errors. Next, contact the credit bureau in writing, explaining the issues. Keep records of all correspondence. Clinical trials suggest that prompt disputes can lead to a quicker resolution. Detailed in our Improving Credit Score Guide analysis, this can improve your score.

Credit Karma vs MyFICO: Which is better?

Credit Karma offers a free VantageScore 3.0 based on TransUnion and Equifax data, along with various tools. MyFICO provides FICO Scores from all three bureaus but may require payment for full access. Unlike Credit Karma, MyFICO offers greater accuracy as it uses the scores most lenders rely on. Industry – standard approaches often recommend MyFICO for those seeking the most reliable credit assessment. Results may vary depending on individual credit situations.